Silverman x, House & Condo Lawyer. We're not just ordinary individuals but we're professionals who truly understand the complex laws of real estate! Especially in matters concerning condominium juristic persons or village juristic persons, with extensive experience in the real estate industry, and as lawyers with over 10 years of experience in real estate law, we have been through court litigation thousands of times! The cases we have been entrusted with are worth billions of baht. We have faced countless significant cases and fought them to the end!

We are not just preparers for winning lawsuits, but we are dedicated to ensuring that you receive the maximum amount of compensation along with the highest possible damages. We have previously won lawsuits involving common area fee disputes, with values exceeding 10 million baht! We stand ready to support you at every stage of the legal process, ensuring your freedom and the justice you deserve.

We are pleased to be one of your allies, to alleviate customers' distress and genuinely protect your rights! If you want to know how to file a lawsuit without losses, how to ensure it's worth the outstanding debt, don't hesitate.Call us now for consultation!

For inquiries about details, fees, or to request a quotation,please contact us at 08-1442-6888

Service for tracking, collecting, and pursuing outstanding “common area maintenance fees“ for both Thai and foreign co-owners/tenants. How can you file a lawsuit without incurring losses? With the expertise of professional real estate lawyers.

We encounter almost every project with unavoidable issues. One such issue is “common area maintenance fee “ collection not being complete. Every committee member must face challenges in managing the juristic person of the allocated village and condominium buildings. Besides managing the maintenance and upkeep of common properties, you also have to deal with various outstanding debts, such as security guard fees, water and electricity bills, and maintenance fees for other common facilities. There are also expenses for hiring various personnel, such as corporate managers, staff, and project technicians. All of these contribute to the main income source, which comes from the “common area maintenance fee“ paid by every co-owner or tenant in each payment period.

The issue of overdue common area maintenance fees is significant. When funds are insufficient for juristic person management, people often hope for outstanding property management company performance in this regard. However, it's often found that some co-owners or tenants tend to neglect or disregard timely payment of these fees or attempt to evade them altogether. Sometimes, they agree to pay only partially as indicated in the invoice. In some projects, income doesn't cover expenses, necessitating funds from reserves each year. In luxurious neighborhoods, the common areas may appear lavish, but cost-cutting measures like not running air conditioning in common areas are implemented to save expenses. It's like having a high-end property management team that the developer initially provides but operates without payment. The difficulties faced by the committee in managing the property themselves lead to neglected management, like swimming pools becoming breeding grounds for mosquitoes, beautiful gardens turning into forests due to lack of maintenance, and some areas becoming crime spots. This is a situation deserving of great sympathy for projects experiencing these issues.

We are professionals in tracking and suing outstanding debts, especially in real estate matters, ready to help you solve any issues you encounter to achieve the best possible results! With our deep legal expertise and understanding, we are prepared to offer tailored solutions to your situation, whether it's through legal claims or other methods, to help you overcome obstacles. Most importantly, you will receive your outstanding payments back to your project as quickly and efficiently as possible.

Mistakes in litigation and monitoring overdue common area maintenance fees

Common mistakes in lawsuits and tracking overdue common area maintenance fees often encountered with condominium juristic persons/village juristic persons include the following:

(1) Unable to pursue overdue common area maintenance fees or debts (which may have been lost) due to the expiration of the statute of limitations of 5 years or allowing co-owners/tenants to be in arrears for more than 5 years, sometimes 7 or even 10 years. In such cases, only the preceding 5 years can be retroactively pursued because exceeding that timeframe falls under the statute of limitations (Commercial and Civil Code Section 193/33).

(2) Overdue common area maintenance fees are the responsibility of the original property owner and cannot be enforced against the new owner or holder of rights in cases like this, often occurring in allocated village projects. This is because transactions do not necessarily require a “debt free certificate“ unlike condominiums. Thus, situations arise where tenants default on their common area fees but have sold and transferred the property to a new owner. However, the juristic person still pursues or files lawsuits for 'outstanding common area fees' against the new owner, who is not obligated to pay for maintenance and public utility management expenses incurred after the transfer (Supreme Court Decision No. 3188/2561).

(3) Hiring a lawyer based solely on cost considerations without understanding the context of debt collection for 'common area fees' or only working to the extent of the contracted value. This often results in incomplete legal actions, filing only as much as contracted, submitting lawsuits without thorough preparation, and omitting additional fees or interest that accrue during the judicial process. When budget considerations are paramount in hiring, many times, the attorney may not fully grasp the context of 'common area fees' debt. This is because, as long as the property titleholder retains ownership rights, the common area fee debt remains continuous, even during the court proceedings, which can sometimes take nearly a year after serving a notice to the property titleholder.

It must be understood that 'filing a lawsuit does not conclude it.' If the lawyer handling the case does not comprehend this point, they may file petitions or pleadings that do not cover continuously accruing debts. They may perceive it merely as a civil case or a typical consumer case, with the asset value equal to the amount claimed. To claim additional amounts, they would need to initiate new proceedings for the new debt, resulting in the plaintiff or the legal entity incurring losses at this juncture. This may necessitate filing a new lawsuit for the increased common area fee debt after the initial case has been enforced.

(4) Foreign nationals residing outside the Kingdom of Thailand or those who have defaulted for more than 2 years may incur additional expenses for translation, document authentication, and Notary services. If a foreign national is not residing in Thailand or has defaulted for more than 2 years, they may need to translate documentary evidence and court summons, send them to their domicile, along with Notary certification. This incurs costs for translation and document delivery, which can sometimes exceed the amount of the outstanding common area fee debt, along with legal fees for hiring a lawyer (Civil Procedure Code, Section 93).

For inquiries about details, fees, or to request a quotation,please contact us at 08-1442-6888

Laws allow for retroactive claims within 5 years!

Don't exceed it!! Otherwise, your project may lose its rights.

The Civil and Commercial Code,

Section 193/33, grants the right

to claim with a limitation

period of 5 years.

1. Accrued interest

2. Payments for installment returns

3. Unpaid property rent, except for property leasing fees as per Article 193/34 (6)

4. Outstanding payments include salaries, annual bonuses, retirement funds, caregiver allowances, and other similar payments structured as periodic installments.

5. The right to claim under Sections 193/34 (1), (2), and (5) which are not subject to the two-year limitation period.

The outstanding common area fees fall under clause (4) and have a statute of limitations of 5 years, hence can only be reclaimed retroactively for up to 5 years!! Even if they have been outstanding for several decades. Therefore, property managers of condominiums and buildings should not overlook this!

Tracking common area fees for Thai homeowners is already challenging, and it's even more difficult for foreign residents!!

Finding outstanding common area fees for condominiums and communities deemed challenging, and seeking Thai homeowners collectively is not easy. Moreover, if you intend to locate foreign residents to track their common area fees, it becomes even more challenging!

Even tracking common area fees among us Thai homeowners is already quite challenging. Now, imagine having to track these fees with foreign co-owners, involving much more complex legal processes. Additionally, there are communication and language barriers that further complicate the claims process

Did you know that tracking common area fees with foreign co-owners who have different nationalities could result in additional expenses if the fees are overdue for more than 2 years? These additional expenses could be 2-3 times higher than the normal fees, especially in the past 3-4 years. This is because foreigners have been increasingly investing in our condominiums and buildings, with some buildings nearing a 49% foreign ownership rate, increasing every year.

The increased foreign ownership up to 49% has made tracking common area fees feel like a more complex task. Do you think it's easy? Being a professional in common area fee tracking allows us to see the various trends in overdue payments!

If foreigners are absent or have overdue payments for more than 2 years,

they may need to translate the supporting documents and court summons,

and send them to their domicile, along with a Notary certified signature!

According to Section 83 of the Civil and Commercial Code: In cases where the obligor does not have a domicile within the Kingdom, the initial summons and complaint must be sent to the obligor at their domicile or the office of their business establishment outside the Kingdom, unless the obligor conducts business within the Kingdom either personally or through a representative, or in cases where there is an agreement in writing specifying the documents to be sent to the obligor, in which case the summons and initial complaint must be sent to the obligor or their representative. In serving the summons and documents to the obligor or their representative for conducting business or receiving legal documents, it should be done at the place of business or the domicile of the representative within the Kingdom, depending on the circumstances. In cases where an external person without a domicile in the Kingdom is summoned as a party according to Section 57 (3), the provisions of one paragraph may be used accordingly.If a co-owner does not have a domicile in the country (has not been in Thailand for more than 2 years and does not have any business, company, or representative), the documents and court summons must be sent abroad to the co-owner's domicile, which must be translated and notarized. The expenses incurred in this process can be significant, sometimes even exceeding the overdue common fees and attorney fees!

For inquiries about details, fees, or to request a quotation,please contact us at 08-1442-6888

The relevant laws are - Condominium Act and Land Allocation Act.

Condominium - Relevant laws: Condominium Act B.E. 2522 and Condominium Act (4th Edition) B.E. 2551.Condominium Act B.E. 2522, Section 15, stipulates that the following properties shall be deemed common properties.

(1) Land on which the condominium is located (e.g., lawn, tree-planted areas).

(7) Other properties provided for common use or mutual benefit (e.g., elevators, guest chairs, sofas, lamp posts, trash cans).

(2) Land intended for common use or mutual benefit (e.g., parking lots, landscaped areas).

(8) Office space of the juristic person of the condominium (additional as per Section 8 of the Condominium Act (No. 4) B.E. 2551).

(3) Structures and constructions for stability and protection against damage to the condominium (e.g., pillars, roofs, awnings).

(9) Real estate acquired or obtained under Section 48 (1) (additional as per Section 8 of the Condominium Act (No. 4) B.E. 2551).

(4) Buildings or parts of buildings and equipment intended for common use or benefit (e.g., parking garage, balconies, staircases, walkways).

(10) Property used for expenses under Section 18 for maintenance and management (additional as per Section 8 of the Condominium Act (No. 4) B.E. 2551)

(5) Tools and equipment intended for common use or benefit (e.g., lawnmowers, water pumps, project shuttle).

(11) Construction or systems built to maintain safety or environmental conditions within the condominium, such as fire prevention systems, lighting arrangements, ventilation systems, air conditioning, drainage, wastewater treatment, or waste disposal, and pollutants (additional as per Section 8 of the Condominium Act (No. 4) B.E. 2551).

(6) Facilities provided for the common use of the condominium (e.g., library, swimming pool, sports fields, playground).

The Condominium Act B.E. 2522, Section 14, as amended by the Condominium Act (Version 4) B.E. 2551, Section 7:

“Section 14: The proportion of common ownership rights in the common property of co-owners shall be based on the proportion of the area of each unit to the total area of all units in the condominium, while applying for the registration of the condominium under Section 6.“

The Condominium Act B.E. 2522, Section 18, as amended by the Condominium Act (Version 4) B.E. 2551, Section 10:

Section 18: Co-owners must jointly bear the expenses arising from the provision of common services and from the maintenance of equipment and facilities provided for common use or mutual benefit, including expenses for the care and management of the common property, in proportion to the share of common ownership rights of each co-owner under Section 14 or according to the proportion of benefits derived from the unit. This is in accordance with the regulations stipulated for land and building owners under Section 6, who are co-owners of units that have not yet been transferred to any individual. They must jointly bear the expenses as stated in the first and second paragraphs for such units.”

Section 18/1 of the Condominium Act B.E. 2522, as further amended by the Condominium Act (Version 4) B.E. 2551, Section 11:

““In the event that a co-owner fails to make payment according to Section 18 within the specified time, they shall incur additional charges at a rate not exceeding 12 percent per annum of the outstanding amount without compounding. This is in accordance with the regulations stipulated. Co-owners who are in arrears according to Section 18 for more than 6 months shall incur additional charges at a rate not exceeding 20 percent per annum and may be subject to the suspension of common services or the use of common property as stipulated in the regulations, including being deprived of the right to vote in general meetings. The additional charges mentioned herein shall be considered as expenses according to Section 18.“

The project of allocating land plots for houses, townhouses, and commercial buildings

- related to the Land Allocation Act B.E. 2543.

Section 46 provides that once a juristic person village has been registered, it has the status of a juristic person. The juristic person village shall have

a committee to administer the affairs of the juristic person village in accordance with the laws and regulations of the juristic person village,

under the supervision of the general meeting of members.

The village allocation committee acts as the representative of the juristic person village in matters related to external individuals.

Section 47 states that once a juristic person village has been established according to Section 45,

every land purchaser in the allocation shall become a member of the juristic

person village. In cases where there are sub-allocated plots of land that have not been purchased or transferred back to the land allocator, the land allocator

shall become a member of the juristic person village.

Section 48 stipulates the following powers and duties for the benefit of land purchasers in the allocation:

(1) Establish regulations regarding the use of public utilities.

(2) Establish regulations regarding residency and traffic within the allocated land.

(3) Collect fees for maintenance and management of public utilities in the area for which the juristic person village has responsibility, from its members.

(4) File complaints or act as representatives in lawsuits on behalf of members in cases where the rights or benefits of ten or more members are affected.

(5) Provide public services for the welfare of members or allocate funds or assets for public benefit.

(6) Carry out any other activities in accordance with ministerial regulations, regulations of the central land allocation committee,

or regulations of committees empowered by this Royal Decree.

Operations under (1), (2), and (5) must receive approval from resolutions passed at general meetings of members.

Section 49 stipulates that maintenance and management fees for public utilities shall be collected monthly from sub-allocated land plots in the land

allocation project. These fees may be set at different rates depending on the type of land use or the size of the area, as determined by regulations

set by the central land allocation committee.Land purchasers in the allocation shall be responsible for paying maintenance and management fees

for public utilities for the land they have purchased, while the land allocator shall be responsible for paying such fees for sub-allocated land plots

that have not yet been purchased.The establishment and amendment of maintenance and management fee rates must receive approval from

resolutions passed at general meetings of members according to Section 44 (1) or from committees as specified in Section 44 (2).Maintenance and

management fees for public utilities shall be collected once the juristic person is established according to Section 44 (1) or upon approval from the

committees specified in Section 44 (2). The juristic person or the entity responsible for maintaining public utilities, as approved by the committees

specified in Section 44 (2), shall have the authority to collect, establish criteria and methods for collection, and maintain accounts in accordance with

regulations set by the central land allocation committee.

Section 50 specifies the following responsibilities regarding the payment of maintenance and management fees for public utilities as stated in Section 49

: Individuals who fail to pay the aforementioned fees by the specified time shall be liable to pay a late payment penalty at a rate determined by the committee.

Those who are delinquent in paying maintenance and management fees continuously for three months or more may have their services or rights to use public

utilities suspended. In cases where payment is continuously overdue for six months or more, authorized officers have the power to suspend the registration

of rights and transactions in the allocated land of the delinquent party until full payment is made. In accordance with the criteria and methods set by

the committee, overdue maintenance and management fees shall be considered as debts secured by a mortgage on the real estate above the allocated

land of the delinquent party.

The Regulation of the Central Land Allocation Committee Concerning Criteria

and Methods for Collecting Maintenance and Management Fees for Public Utilities and Accounting, B.E. 2545.

For inquiries about details, fees, or to request a quotation,please contact us at 08-1442-6888

Why should you use Silverman Debt Collection service? How can we assist you?

Our team consists of experienced lawyers in handling international cases and specialists in real estate who have managed community corporate affairs and condominiums. Therefore, they understand the needs and issues regarding 'outstanding common fees' of co-owners very well.

1. We separate the expenses for sending demand letters in both Thai and English languages from the legal proceedings in court to enhance efficiency in controlling corporate expenses. We are ready to provide consultation to ensure that all expenses are clearly specified in the demand letters, which will have legal implications and justify the cost of follow-up actions or engaging our legal team.

2. We have language specialists who serve as contact points for foreign co-owners, lightening the burden by addressing inquiries related to demand letters on outstanding common fees for you.

3. Our team is equipped to handle every step of the process, including document translation, notary services, and enforcement procedures such as asset tracing, foreclosure proceedings, and property sales, to recover outstanding common fees and cover legal expenses.

4. We have clear processes and defined scopes of work, estimating the expenses throughout the process and disbursing funds according to actual expenses, allowing you to efficiently control costs, with no hidden fees and clear reporting to the committee.

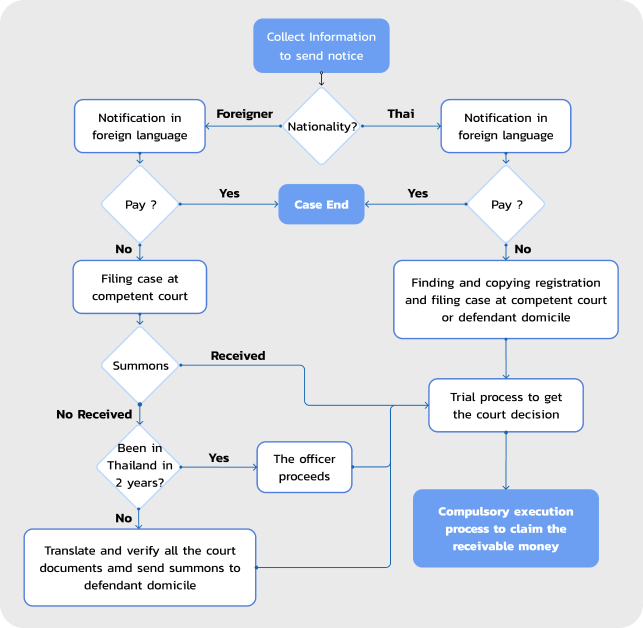

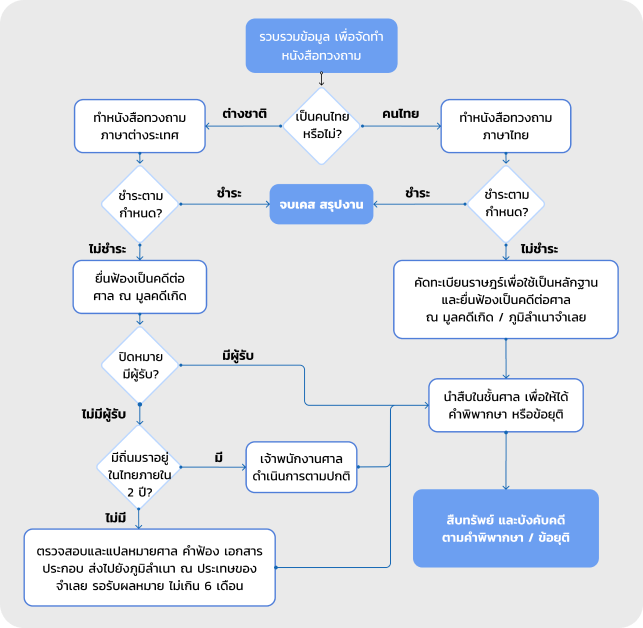

The process of tracking overdue common fees.

Silverman Debt Collection service

Silverman recommends tracking and pursuing legal action against foreign co-owners within 2 years to determine if it's worth the expenses.

For example, for a 1-bedroom condo of 30 square meters with a monthly common fee rate of 55 baht per square meter for 24 months (2 years),

the total amounts to 39,600 baht (excluding fines). key issue is ensuring that the co-owners' outstanding balance is rightfully obtained to manage

the condominium. Therefore, it's crucial to initiate the process by sending a demand letter detailing all expenses, including attorney fees, court fees,

and enforcement costs, for potential legal action if the co-owner refuses to pay until the matter escalates to court and becomes enforceable with a

court order.For instance, the outstanding balance of 39,600 baht plus fines and enforcement costs if legal action is necessary.

Additional advice for tracking ”Outstanding Common Area Fees” cases

1. Specify fines and enforcement costs in the corporate regulations.

2. Monitor to ensure that co-owners/tenants do not exceed a 5-year overdue period, leading to the statute of limitations preventing full collection.

3. For foreign co-owners, it's advisable not to let common area fees remain unpaid for over 2 years, as it can lead to substantial legal expenses if legal action becomes necessary.

4. Co-owners cannot evade payment of common area fees by alleging that the developer or corporate entity mismanaged the funds or didn't properly maintain the common property, as per the Civil and Commercial Code B.E. 2553.

5. Corporate entities of residential buildings can suspend water supply or restrict access to project facilities for co-owners who fail to pay common area fees, but such actions must adhere to legal provisions as per the Condominium Act B.E. 2553.

6. Corporate entities of residential buildings can issue regulations except for those exempted, such as units held for sale, which should not be exempt from paying common area fees, as it would contravene the law as per the Condominium Act B.E. 2553.

7. Common area fees incurred after a court judgment can be claimed again by corporate entities by filing a declaration before the property is auctioned.

8. According to the regulations of the Bangkok Metropolitan Land Allocation Committee, fines should not exceed 10% of the outstanding amount (for horizontal projects, single houses, duplexes, and townhouses).

9. Utility charges should be collected monthly according to the law; however, if approved by the general meeting, members can resolve to collect them annually.

For inquiries about details, fees, or to request a quotation,please contact us at 08-1442-6888

Register now for receiving free special benefits! SPECIAL LIMITED OFFER

Please register for receiving more information from staff

Free Consult

Satisfaction Guaranteed

Cancel the service for a full refund up to a period of 30 days